Wise’s Astonishing Growth: Innovation, Disruption, and Global Success in Fintech

A Lesson in Innovation and Business Disruption

This report aims to examine and assess the extraordinary growth and success achieved by Wise, the UK headquartered fintech Services Company, especially from the perspective of enterprise management and the driving of business growth.

Enterprise management is a wide and complex activity that incorporates the development and implementation of strategies for growth, operations, human resource management, financial management and the achievement of competitive advantage, amongst others.

Whilst Wise has grown swiftly in its chosen area of business and has disrupted the area of international money transfer, it has not been accorded the amount of respect and recognition that has been given, for example, to other disruptors like Apple or Google or Tesla; amongst others.

This report examines the use of extraordinary business ideas and strategies used by the firm, the sharp growth achieved by it over the last decade, and the considerable difference it has made to individuals and organisations in this dynamic and difficult era of globalisation.

WISE: Organisational Overview

WISE was established in 2011 in London, United Kingdom, by two young men who came to the UK from Estonia to build their careers. Taavet Hinrikus and Kristo Käärmann needed to regularly send money out of the country and found the process inefficient, tedious and expensive. Putting their heads together they created a simple and beautiful process to speed up their international money transfers and drastically reduce their costs (Wise, 2025).

The company created by them with the mission to make international money transfers, fast, easy and cheap has over the last decade disrupted the activity of international money transfers; which was dominated till then by large banks with international operations. Their services enabled people and businesses to move their money swiftly and with much lesser costs. The company progressively increased its services to include debit cards for shopping and spending, whilst abroad, and hold balances in multiple currencies.

Wise has partnered with organizations like Monzo and Bolt to provide better international banking than their existing service providers. Visionaries like Richard Branson and Max Levchin, the co-founder of PayPal have recognized the potential of their services and invested in the company (Marketa, 2024).

The company has grown sharply over the last 12 years in both revenues and profits. It earned total revenues of 1052 million GBP and profit before tax of 481.4 million GBP in 2024. Its profits practically tripled from 146.5 million GBP to 481.4 million GBP during the same period. Earnings per share grew by 197% in 2024 compared to 2023 (Wise, 2025).

Innovate, Disrupt and Grow

There is wide agreement amongst policy makers, business leaders, academics and organisational managers on the importance of business growth. McKinsey and Company stated that the achievement of business growth is the most important requirement for a business entity (Cezim, 2025). The absence of growth leads to stagnation, a moribund organisation and inevitably business closure (Kotter, 1996).

The achievement of growth results in a number of consequences including enhancement of revenues, growth in profits, increase in financial power; and the various benefits that such power can bring to an organisation (The Business Proessor, 2025). These include the capability to purchase current and capital assets, increase advertising, develop markets, drive innovation and provide new products to customers. Growth in business revenues and profits helps in enhancement of national GDP and government taxes (Brower, 2022). It helps the organisation to provide new products to customers, improve their quality of life, earn customer loyalty and improve organisational reputation.

The founders of Wise, notwithstanding their youth, had a strong understanding of the need for growth and the best possible ways of achieving it. They made use of three strategic models for this purpose, namely the Blue Ocean Strategy, Porter’s Generic Theory on Strategies and the Ansoff Matrix. They used these models to decide the product and the market for their organisation, the overarching corporate strategy for achievement of growth and the procedure in which this growth could be realised in a structured, progressive and sustainable manner (Wise, 2025). These three strategies and their application by Wise have been taken up for detailed discussion and analysis in the following three sections.

Apply the Blue Ocean Strategy

Wise is an excellent example of the development and implementation of a blue ocean strategy in the fintech sector. The founders of the firm created an absolutely new market space by providing considerably easier, cheaper and more transparent services for international fund transfers (Kim & Maubourgne, 2004) . The offering of their services disrupted the conventional and frequently high cost existing banking model for international transactions. Their strategy made competition practically irrelevant and provided considerable benefits to millions of users across the world.

The creation of this blue ocean model is the fundamental cornerstone of the company’s strategy. Wise fitted the blue ocean model perfectly because it targeted an uncontested market space, differentiated its product, provided it at low cost and drove the business through sophisticated technology, customer satisfaction and market expansion.

Compete with Porter’s Generic Strategy

WISE made use of the Blue Ocean strategy to develop a product for a new market. It thereafter developed a competitive strategy to achieve market growth and competitive advantage; a strategy that was differentiated from others and cost effective.

Michael Porter in his theory of generic strategies advanced two main strategies for business penetration and growth, namely cost leadership and differentiation (Porter, 1985).

Cost leadership focused on developing and selling products that were considerably cheaper than competing ones. The offer of cost effective products would attract consumers and help the organisation to develop strong competitive advantage and achieve high sales volumes. Porter stated that whilst most business people wished to sell products at economic prices, there was a lower threshold that could not be breached without incurring losses. True cost leadership entailed the combination of scale economies, capital investment, efficient buying, good supply chain management and a tight cost control structure. It required considerable investment, effort and organisational control.

Differentiation on the other hand entailed the development of products that were superior to others with respect to design, appearance, quality, features and longevity, amongst others. These differentiating features enabled the organisation to generate considerable competitive advantage; by increasing prices, attracting customers and earning profits. Michael Porter further declared that business organisations, to be successful, must adopt either of these two strategies to avoid confusion and incompatible business priorities.

Porter’s theories of cost leadership and differentiation have been recognised, appreciated and implemented by business leaderships with good results (Porter, 1985). Notwithstanding their popularity and their widespread use, present day business leaders, entrepreneurs and academics have altered their perceptions on using these strategies The Business Professor, (2025). Unlike Porter’s deep-rooted conviction about the exclusivity of these strategies in the setting of business/ market strategy for a given firm, present day business experts feel that they can be married and used in tandem to achieve good results. This is based on the assumption that it is but natural for a consumer to like good quality and attractive features along with an economic and an affordable price in a product.

Many corporations like, for instance, Toyota and Samsung are providing attractive products with several features at attractive prices. Toyota’s lead has been followed by Korean automobile makers like Hyundai and Kia, both of which have been successful in increasing their sales and profits. Even Tesla, which has always been known for its expensive automobiles, has lowered its prices without reducing its features to bring it within the reach of the common man.

Wise has from the beginning adopted a dual/ hybrid strategy of cost leadership and differentiation. The firm differentiated its products by bringing in complete clarity in the international money transfer procedure and making the process easy and satisfying to customers; the company’s leadership furthermore priced its money transfer services extremely economically. This double engine strategy powered its growth to extremely high levels, practically disrupting the existing international money transfer business.

Use the Ansoff Matrix for Strategy

The Ansoff matrix developed by Igor Ansoff in 1957 continues to be a powerful and widely used tool for development of business strategy and achievement of growth. As stated earlier, all organisations must continuously strive to achieve growth. Such a task is however not easy and many attempts to achieve growth end in confusion, failure and business losses (Ansoff, 1957).

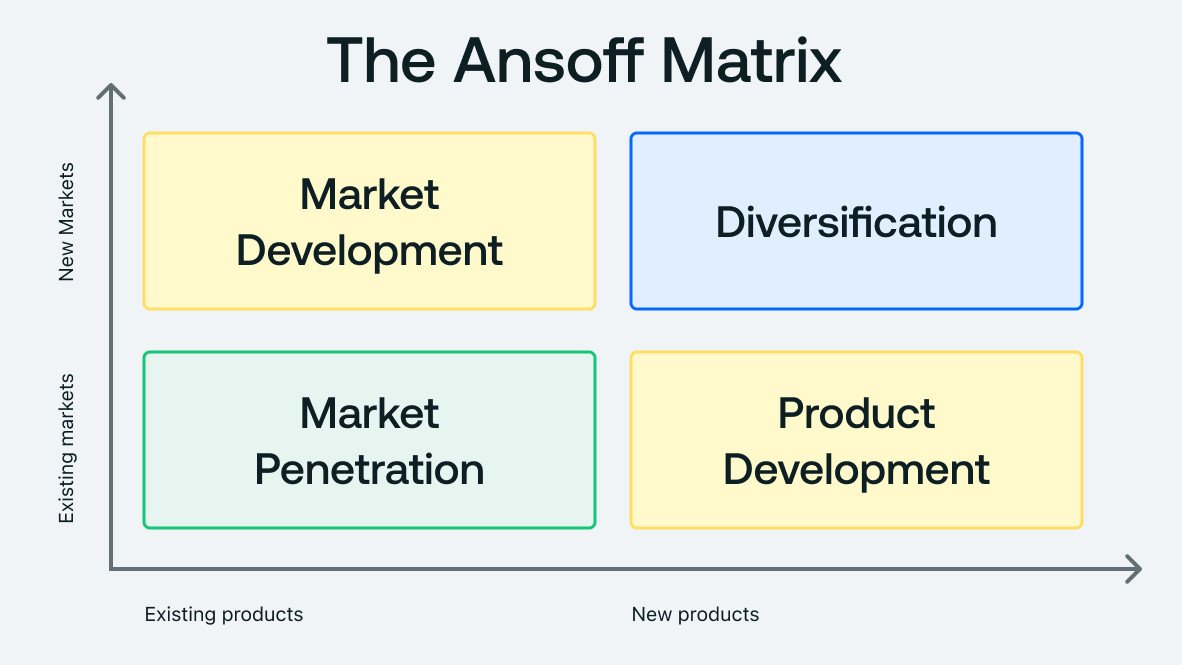

The Ansoff matrix helps businesses to examine their products and their markets and to subsequently develop a structured strategy for systematic and sustainable growth.

The matrix, which is illustrated above, has four quadrants, which stand for market penetration, development of new products, market development/ expansion and diversification. Market penetration, which is the first quadrant of the matrix calls upon business firms to work on enhancing sales of existing products in existing markets. This is a conservative strategy that aims to steady the business in its initial stages; when it needs to take baby steps and establish itself. The firm focuses on product quality, pricing strategies and market share. The second stage, namely, market development, encourages organisational managements to take their existing products, with which they have acquired considerable familiarity, to new areas and new geographies. Market development helps in growing existing markets with familiar products and building financial strength and organisational resilience.

The third step, known as product development, calls upon business leaderships to develop new products and use them to sell them in both existing and new markets. The last step, namely diversification is associated with the establishment of new businesses in new territories.

Wise operates at present in the first three quadrants of the Ansoff matrix. It started with the development of its first product, i.e., International money transfer services with high degrees of transparency at very economic costs. It started offering these services in the UK in its earlier years. It thereafter moved into the second quadrant of the matrix and spread its business footprint in specific geographies, namely North America and Asia where it created attractive markets and gained customer trust and acceptance.

It finally moved into the third matrix namely product development by introducing multiple currency compatibility, debit cards that could be used in other geographies and business accounts (Wise, 2025). The adoption of the tenets of the Ansoff matrix helped the firm to progressively increase its sales, grow its geographic footprint and provide a range of useful products to its customers; all of which contributed to enhancement in revenues and growth in profits and organisational wealth.

Kill with Technological Innovation

The founders of Wise, when they launched the company in 2011, adopted the mission of making international money transfers simple, clear and cheap. The organisation developed a service that helped individuals and small and medium businesses to move money across national borders for facilitation of payments, purchases and other reasons. The firm offered considerably swifter and cheaper international transfers, compared to traditional banking routes with the help of a brilliantly conceived and innovative closed loop system (Wise, 2025).

It tackled the issue of cheap and instant international money transfer with a digital product that was driven by the technology that was then used within the bank system. The firm established its own bank facilities in the various countries, they decided to support and service. It received money into its local bank account from the sending customer and thereafter transferred a similar amount to the receiving person from its bank account in the destination country. Wise provided details about the origination of the money and the completion of the money transfer, but in reality the money was paid out to the recipient from a local bank account.

This method of fund movement was much faster than the Swift based banking transfer system. The firm spent considerable time and money to ensure that it worked within local regulations and that it did not break any laws, rules and regulations. Wise used the technology available for KYC, (know your customer), to eliminate intermediaries, reduce fees, eliminate fraud and generate transparency by providing live foreign exchange rates. The company was able complete transfers swiftly; most transfers happening within a couple of hours.

Academics and business leaders agree that Wise is a strong example of disruptive innovation, because of its clear mission, (namely money without borders), along with instant payments and high levels of transparency. It competes with traditional banks, remitters like PayPal, credit card companies like MasterCard and Visa, international networks like Western Union and e-commerce entrants. As of now, Wise is cheaper than all its competitors but things could change with growth in real-time rails across the world (Yazuci and Ruzgar, 2019).

The organisation subsequently developed other innovative financial products like multi-currency accounts, international debit cards and business accounts to provide customers with more value.

The company provides a brilliant example of how to create a large, fast-growing, ethical, sustainable and useful business primarily with ingenuity and good implementation.

Astonishing Growth

This penultimate section of the report provides some important information on WISE’s growth from its year of inception, i.e. 2011 till today (Wise, 2025).

The organisation has achieved remarkable growth year on year during this period. The firm recorded revenues of 1052 million GBP in the financial year 2020-4 compared to 846.1 million GBP in 2020-3. This considerable increase of 31% YOY shows its increasing customer base and its large global reach.

Total active customers in 2024 were 12.8 million compared to 5.4 million the year before. Gross profit grew by 71% every year and increased from 38.2 million GBP in 2023 to an unprecedented figure of 1092.4 million GBP in 2024. Earnings per share increased by 197% and amounted to 34.2 P in FY2024 compared to 11.07 P a year earlier.

Wise now has three major products namely WISE Account for personal users, WISE Platform for banks and WISE Business for SMEs. The organization is launching new services in China, Australia and Brazil.

About 51% of its employees are women; half of WISE’s global teams have more than 50% women leaders in the senior ranks. Women hold 45% of managerial positions and 32% of senior leader positions. This indicates that whilst the organisation has an inclusive workforce at the general level, it needs to do more to achieve gender diversity in the roles of higher leadership.

Conclusion

The detailed study carried out for the preparation of this report indicates that Wise, a company established in 2011 in the UK has achieved remarkable growth and success in the course of the last 14 years. The firm was established by two young men who came from Estonia to build their lives and careers in the UK. They showed remarkable understanding of their business environment and excelled at choosing opportunities that had escaped numerous experts before them (The Strategy Institute, 2024).

Their grasping of an opportunity in international transfer of funds resulted in the adoption of a blue ocean strategy in business and the development of a unique service product, namely a process for the swift transfer of funds from one country to another with transparency and at economic costs. The senior management, faced with the task of formulating a marketing and business strategy, made use of Michael Porter’s long established and widely accepted theory of genetic strategies and tweaked it to develop a hybrid offering that combined differentiation with cost leadership and swiftly became very attractive to customers; after penetrating the market the firm made use of the Ansoff matrix to follow up market penetration with market expansion and finally product development. The organisation continued to develop innovative products like international debit cards, multiple currencies and business accounts stock.

It’s operational and revenue figures detailed in the earlier section reveal that the organisation has truly achieved remarkable results in the last 14 years. There is little doubt that the firm operates in a very competitive space and its competitors including banks, money remitters and other fintech companies will strive to cut into its customer base. The leadership has however shown enormous business acumen and an understanding of priorities by making use of the right strategies, constantly working on innovation, operating effectively within the regulatory frameworks of different countries, generating new products, and entering new geographies. The management has overcome numerous challenges and exploited hardly visible opportunities to arrive at where it is today.

It would not be out of place to expect the business to continue to do well in future, despite an extremely competitive and difficult global business environment.

References and Bibliography

- Ansoff, H. I. (1957). Strategies for diversification. Harvard Business Review, 35(5), 113–124.

- Brower, T. (2022, April 3). Change management for hybrid work: 6 ways to create success. Forbes. https://www.forbes.com/sites/tracybrower/2022/04/03/change-management-for-hybrid-work-6-ways-to-create-success/

- Cezim, B (2025) Business-to-you.com. (2024). Top business, strategy and management frameworks explained. Business-to-you.com. https://digitalagencynetwork.com/author/berfin/

- Christensen, C. M. (1997). The innovator’s dilemma: When new technologies cause great firms to fail. Harvard Business School Press.

- Kim, W. C., & Mauborgne, R. (2004). Blue ocean strategy: From theory to practice. California Management Review, 47(3), 105–121. https://doi.org/10.2307/41166308 Kotter, J. P. (1996). Leading change. Harvard Business Review Press.

- Marketa, F, (2024), Smart Marketing Strategies for small businesses, https://wise.com/gb/blog/smart-marketing-strategies-for-small-businesses

- Porter, M. E. (1985). Competitive advantage: Creating and sustaining superior performance. Free Press.

- The Business Professor, LLC. (2024). Porter’s generic strategies – explained. The Business Professor.

- The Strategy Institute. (2024). The Ansoff matrix: A powerful tool for business strategy and growth. The Strategy Institute.

- WISE. (2025). https://wise.com/owners/results-reports-presentations

- Yazici, M., & Rüzgar, N. (2019). Can disruptive technologies be considered as blue ocean leadership strategy and be used as a tool for competing in international markets? Turkish economy case. International Journal of Information Research and Review, 6(2), 5930–5935